Demonetisation in our economy has given us the ride Prime Minister Modi wanted to provide, a time when we are running cashless, so as to drive out the black money from the country and fulfill the PM’s dream of making India a cashless society.

With a sharp increase in the number of digital options, it is quite possible to manage most of the day’s expenses without too much of hard cash. You can pay for a taxi by using a mobile wallet. Those travelling by metro, bus or train, can use smart cards to pay for the service. Lunch in the college canteen can be bought using coupons. Although the occasional shopping from fruit vendors and roadside tea stalls calls for cash in hand, it isn’t a major amount. So, the government order banning currency notes of Rs 500 and Rs 1,000 should not really scare anyone, right? No. Cash is still king for a large number of Indians simply because it is widely accepted and very convenient.

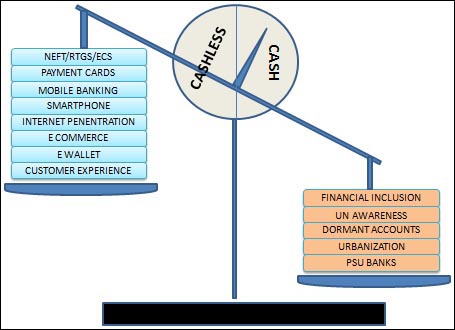

The challenge in going cashless is that there is no other close alternative to cash. Thus, digital payments account for only 10 percent of the transactions whereas cash payment makes up the other 90 percent. But the number of banks providing card payment option has increased from barely 60 in 2011 to more than 700 today. The card base- both credit and debit card- has also crossed 750 million. In a more speculative manner, the government is trying to drive the force to move into cashless transactions but are quietly ignorant about the spending habits of the people. The penetration of acceptance infrastructure is currently at dismal 1.3 million point-of-sales terminals. As long as the acceptance infrastructure in India does not match the pace of growth of cards and other cashless modes, customers will use cash, says an economic advisor. For a vast country like India, having only 2.3 lakh ATMs and 14 lakh POS terminals is too low. For ATM transactions, while the acquiring banks would like the ‘interchange income’ to go up, the issuers are not interested. Even White Label ATM (WLA) providers have stopped expanding the ATM network under the fear that the acquiring fee would be under stress if it is revised downward. For POS transactions, it is primarily an issuer market and profitability of the acquiring business is under threat.

Prime Minister Narendra Modi admitted that he understands making the transition to cashless economy is difficult and hence he urges people to move to less cash society. However, the whole exercise of moving from cash-driven economy to cashless economy has somehow been mixed with demonetisation which was apparently done to suck out liquidity from the system to dig out black money. It is a mammoth task to achieve even one of the two. Aiming for both in one move is risky and to some extent reckless. If the move was aimed at turning India into a cashless economy, then the ideal thing to do was to make people adopt e-payments as a change of habit and not as a last ditch option in a cashless crisis situation. Though services like internet banking, online transactions, initiation of mobile wallets like Freecharge and PayTm have been promoted and encouraged nation-wide, in rural areas, farmers and poor people are still struggling to get their hands on their own money. They are selling their produce in the markets at throwaway prices because buyers don’t have cash to pay them. Mobile ATMs and Micro ATMs have been a rare sight and normal ATMs usually stay shut at least a couple of days every week now. So the change in habit seems to be forced rather than incentivised and simplified for convenience. Also, it remains limited to urban areas. Rural population is left in worse off conditions. So it has left people wondering which way is right!

Radhika Boruah

[email protected]

Image source: Google.com