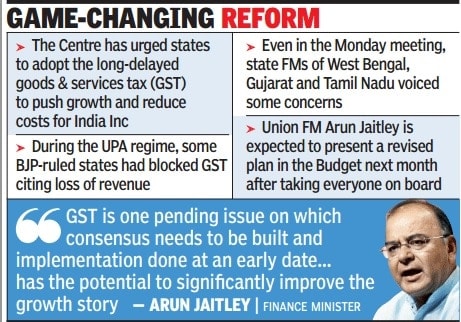

One of the most famous promises of the Modi sarkaar has been the introduction of GST as a substitute for the cumbersome indirect tax structure of India. Just before the year comes to an end, the signs of GST becoming a reality by April 2016 have started to show.

Here’s a brief ‘myth- buster’ about the Goods and Services tax (GST) separating what we’ve heard about this proposed tax policy from what it is actually about.

1. GST is a complex tax with taxation at various stages. All business houses and tax payers might not understand it well.

Anything that is newly introduced is surrounded by an envelope of ambiguity and resistance to change. However, GST is a simple multi stage tax that replaces the complex Indian indirect tax structure. It is an input tax wherein the amount you pay simply reduces the amount you owe.

Example: ‘Dreamica‘, a biscuit producing company purchases raw material of ?500 lacs (@10%), incures production cost ?50 lacs and adds operating profit of ?100lacs, gross sale price being ?700 lacs( ?500 lacs on procurement + ?50 lacs tax on procurement + ?50 lacs on cost + ?100 lacs of profit )

Total tax payable (Under Traditional Indirect Tax Regime): ?120 lacs( ?50 lacs on procurement + ?70 lacs on sale)

However, total tax payable (Under GST): ?70 lacs (?50 on procurement + ?70 on sale – ?50 input tax credits already paid on procurement).

Thus, GST provides a simple tax structure beneficial to business houses as well, since it reduces tax burden on producers.

2. GST is another indirect tax imposed by government pressurizing the already burdened tax payers.

GST shall be introduced in a two fold structure at centre and state level, sub summing Service Tax, Excise and Custom duty on centre level and Entertainment tax, Value Added Tax (VAT), entry tax, Luxury tax etc on state level. The Central Service Tax shall be totally phased out. Thus, GST doesn’t further pressurize the tax payers, it eases the process and compliance formalities.

3. GST takes money out of the state treasury causing loss of revenues and fills in the treasury of Central Goverment.

The numerous state duties imposed by state governments constitute a significant portion of their revenue. With introduction of GST, it is argued that the state government will lose its revenue to the Centre. However, this isn’t the case as GST broadens the base of tax payers and consequently the tax collections would increase. Further, Centre has promised compensation for 3 years to state governments to make up for any perceived losses. Moreover, the state is entitled to collect GST from producers with turnover between ?25 lacs and ?1.5 crore, and Centre shall collect GST fom producers with turnover beyond 1.5 crores.

Thus, GST nowhere causes loss of revenue to state governments.

4. When input tax credit mechanism already exists in VAT, GST doesn’t really add much to the tax structure and is an unnecessary improvement.

It is true that producers can off set the tax paid on input against the tax on output, however VAT rates differ for each state. At times state governments engage in undercutting rates to attract pool of investors. Moreover, inter state credit isn’t available under VAT. Hence, GST proposes an improvement over VAT with uniform rates and policies.

5. GST is a one stop solution for tax evasion, misappropriation and host of other issues faced in collection of taxes.

GST provides several benefits to the economy. It boosts the revenue collections of the government. It can be used to reduce the sale of undesirable products such as cigarettes, liquor, tobacco etc by increasing the rate. Moreover, the government can regulate the economy by using GST as an instrument of altering fiscal policy. The economy can be well managed by raising GST rates in period of boom, and reducing it in times of economic slowdown.

However, GST isn’t progressive in nature. It taxes the rich and poor alike. Consequently, the necessities such as housing, food, clothing etc shall become expensive.

6. GST doesn’t justify its cost as compared to the benefits expected.

It is too early to comment so, however the economic agencies are positive about GST proving to be beneficial in all spheres. It shall make India into a unified market. According to the Council of Applied Economics Research, GST introduction can boost our Gross Domestic Product (GDP) by any percent between 0.9 to 1.7. CRISIL report states GST is the best way to mobilize revenue and reduce fiscal deficit.

Clearly, the benefits from GST exceed the drawbacks it faces. It’ll be interesting to see whether GST is able to deliver what it promises, if it is allowed to do so, or will it fall hostage to the great Indian political system.

Feature Image Credits: www.tacx.in

Mridul Sharma

[email protected]

Comments are closed.